A little over one year ago, I wrote a post about Slaying the Debt Monster. It was written in the middle of a very long process, during which I aimed to pay off a huge amount of debt the hard way:

Since [2009], I’ve paid of $48,600 of debt the old fashioned way. I’m still clawing my way out, but the end is now in sight. The final consumer debt piece will be killed in about 3 months, and I will be completely debt free in 12 months. By the end, I’ll have paid off $62,000 in debt since June 2009. ($10,000 of that number is interest paid.)

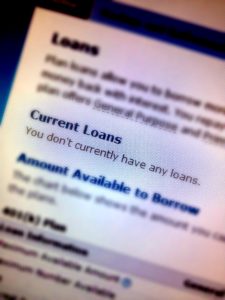

Today is the day that I checked the final loan account and saw this:

I am DONE.

I am living proof that you can pay off a huge amount of debt.

Those figures above, which I wrote in the previous article, are still mostly correct. The total payoff took three months longer than expected, but only because I eventually moved the last chunk of debt into a lower interest loan that had a minimum term of 12 months (meaning that the payoff length expanded, and yet I saved a little money in interest in the long run). That total number of $62,000 is still more than I make in a year. That is a HUGE amount of money to me.

It’s the biggest project I’ve ever completed.

My take-home income for next month will be nearly double what it was last month. I have plans for the money that is no longer being thrown into the debt-canyon: an emergency savings account for unemployment; an IRA; a down-payment for a house; a budget for charity and for friends’ Kickstarter projects. There’s a little bit of cleanup yet to do, too, as I’m in the middle of incurring some moving costs and medical costs that drained down a couple savings accounts I already have… but that will all be replaced within a few weeks. It feels weird to be paying forward instead of backward.

Looking back from the end point, I know that the advice I gave last year is still the same advice I’d give today. However, I also realize that I’m fortunate in many ways. I am American, white, and educated. I was reliably well-employed during the entire duration of the debt payoff. I had enough income to stay well insured. I didn’t suffer any truly horrifying disasters. I stumbled across $3,000 of stock that I didn’t know I had, a remnant from a long-lapsed life insurance policy that my grandmother started in my childhood; without that weird windfall in 2009, I might never have gotten enough of a grip to get started in the first place.

However, the thing that really made this all happen was a willingness to knuckle down and make sacrifices, and then sticking with it for four years. And you know what? It’s been a good four years for me, despite living on the cheap.

It can be done.

Congrats!!!

Thanks!

Congratulations!! One thing I would say is don’t work for a down payment work for a house. Mortgage debt is no less pernicious than other debt and can be even more wearing.

Thanks!

If I could save enough to just buy a house, I would. At this point and given where I live, though, I’d probably hit retirement before I could save enough to pay for a whole house in cash. Also, houses *usually* gain value over and above the value of the loan, which means going into a mortgage earlier rather than later *usually* gives you more bang for your buck. Then again, all those rules got broken over the last several years…

Congrats!

Congrats on a worthy accomplishment. Living debt-free is rather freeing.

So is living job-free, but I need to change that soon! 🙂